For the past five years, Ontario’s housing market has seen many ups and downs. Teranet shares its insights through data gathered from Ontario’s Land Registry in its recent Market Insight Report, which highlights the effects of a post-pandemic market.

Ontario Buyer Segments

Buyer segments are broken down into the following categories:

- Movers: Those who moved from one property in Ontario to another. They have sold their sole existing property and purchased another property within a period of time.

- Multi-property owners: Buyers who, at the time of purchase, also owned other properties in Ontario.

- First-time homebuyers: Buyers who claimed the Ontario land transfer tax exemption for first-time homebuyers, which is only available to buyers who have not purchased property before anywhere in the world.

- Life event: This group represents those who transferred ownership between related parties for nominal value. This could be due to marriage, divorce, or transfer between generations.

- Other: All other buyers, including those from outside of Ontario or Canada, or those re-entering into the property market after an extended absence.

Property transfers by buyer segment as a percentage of total transactions, 2011 to 2024. Source: Teranet

The data shows us that first-time homebuyers–who have always been a stable and strong segment–accounted for 20-25% of the transfer volume in Ontario in 2024.

The segment of movers has begun to dip since the rise of interest rates in 2022, and despite recent cuts has yet to recover.

Multi-property owners continue to be the largest buyer segment in Ontario, though the percent of the total volume they represent has decreased slightly in the past few years.

New Buyer Type: Single-Party Multiple Property Owners

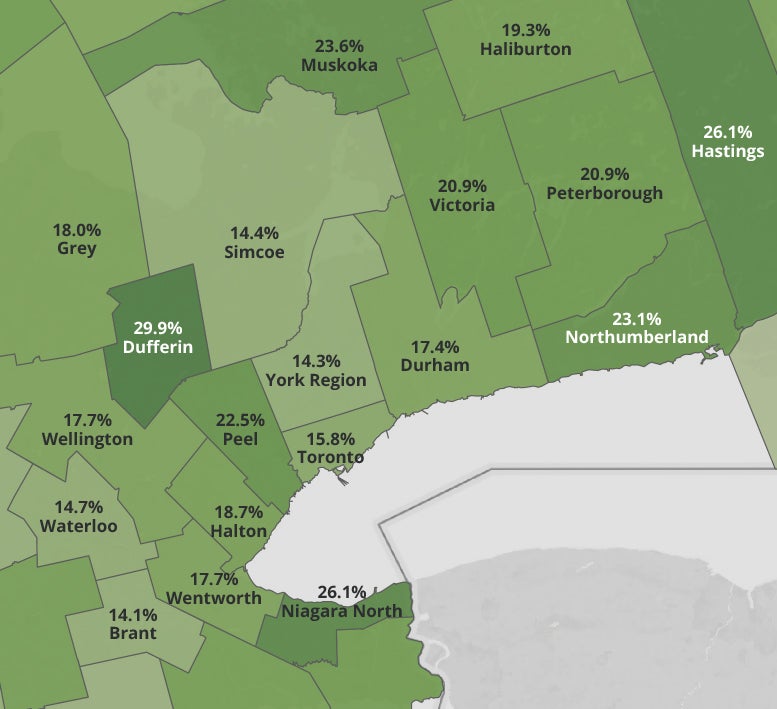

Profile of a new, single-party MPO in 2024, by region. Source: Teranet

In analyzing the multi-property owner segment, Teranet discovered that the second biggest group of multi-property owners are those purchasing properties on their own (the largest segment is two-party groups). Single-party multi-property owners now represent 20% of all multi-property owner transactions.

Regional Spotlights

Toronto condo, annual volume by new construction vs. resale, 2015 to 2024. Source: Teranet

Toronto

Highlights of the Toronto real estate market:- Condos accounted for more than 65% of sales in 2024

- Condo resales were very low; the lowest in the past decade

- However, the transfer of new build condos was 78% higher in 2024 compared to 2023

The report states that 15,000 new condos became ready for occupancy in 2024, which could explain the lower number of sales for resale condos.

Property transfer volumes by 5 Ontario regions by buyer segment, 2020 to 2024 . Source: Teranet

Peel and York Regions

Peel and York represent suburban areas, though they show a difference in trends amongst buyer segments. York was dominated by multi-property owners, whereas first-time homebuyers represented the dominant market in Peel. Peel also remains attractive to multi-property owners, who accounted for just under 25% of total transfer volume from 2020 to 2024.Middlesex (London)

Middlesex has historically been a well-balanced market among all buyer segments, however, first-time homebuyers and multi-property owners have increased their transactions to dominate the market in the past 5 years.Muskoka

Muskoka trends tend to be unique, as it is a region best known for its recreational properties. Unlike other areas analyzed, life event dominates as the largest segment, representing a third of Muskoka’s transfers. Teranet concludes this is likely due to families passing their cottage down through generations.Muskoka also has a high volume of multi-property owner transfers. The other segment is also notable in Muskoka transfers, suggesting that buyers from outside Ontario or Canada could be investing in recreational properties in this region.

Power of Sale Trends

Ontario power of sale transfer volume, percentage of volume by region, 2024. Source: Teranet

When a borrower fails to uphold the terms of their mortgage–that is, they fail to pay their mortgage–the lender can use a power of sale in order to recover their principal, interest, and expenses. Power of sale trends are often a sign of growing financial stress among homeowners.

Pandemic Losses

Many buyers who purchased their home in the height of the pandemic in 2022 and 2023 and then subsequently sold their homes lost money on their properties. According to Teranet’s data, 1 in 4 properties worth under $1 million in 2022 and sold in 2024 incurred losses.

Percentage of properties sold at a loss, by purchase year (2022 and 2023) and sold year (2022 to 2024), by select Ontario regions. Source: Teranet

Check out the full report here: Source